Bank Ownership Networks

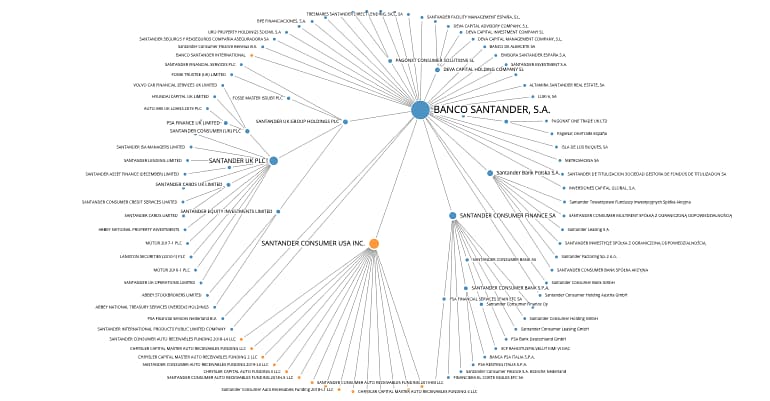

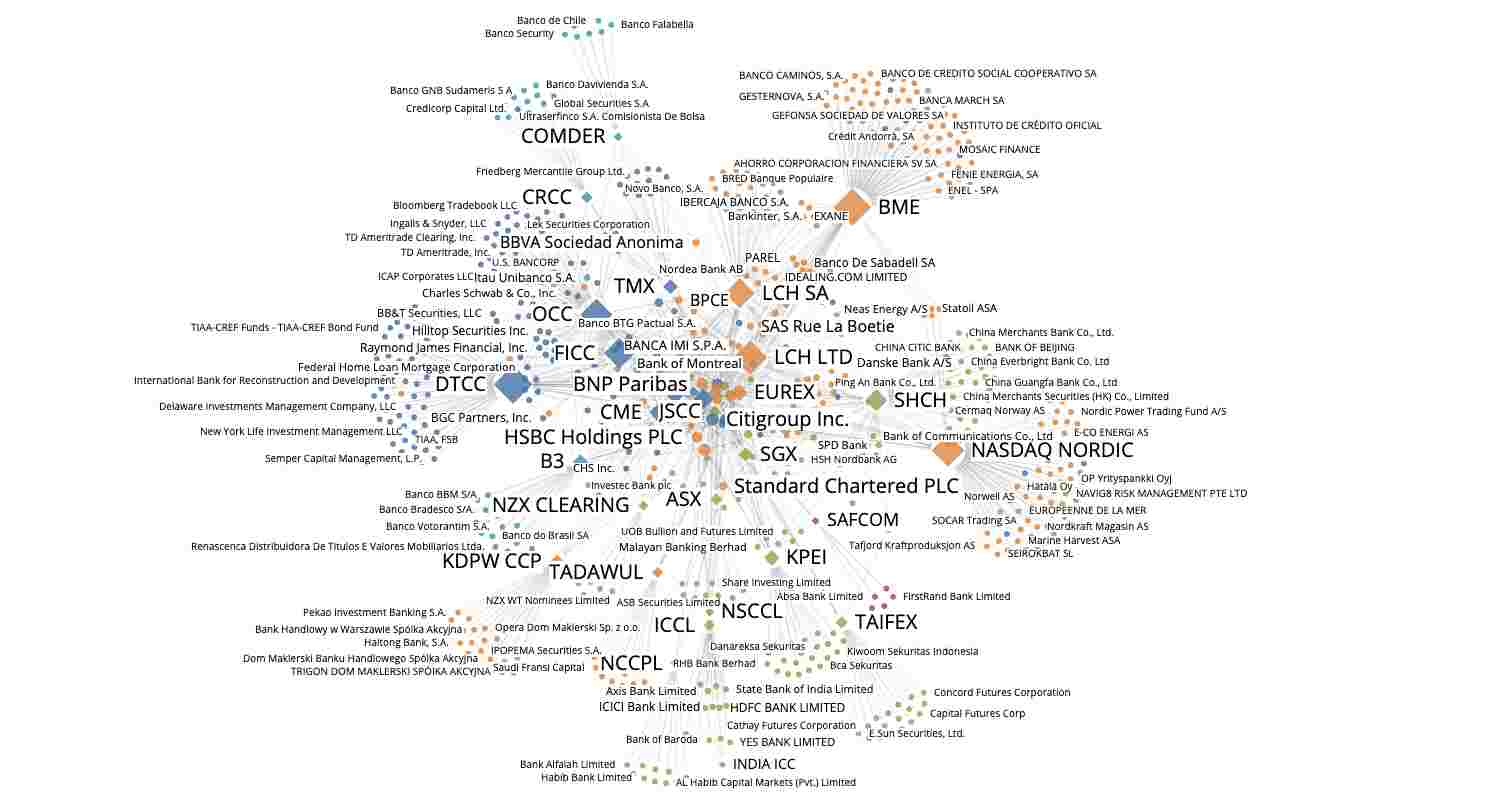

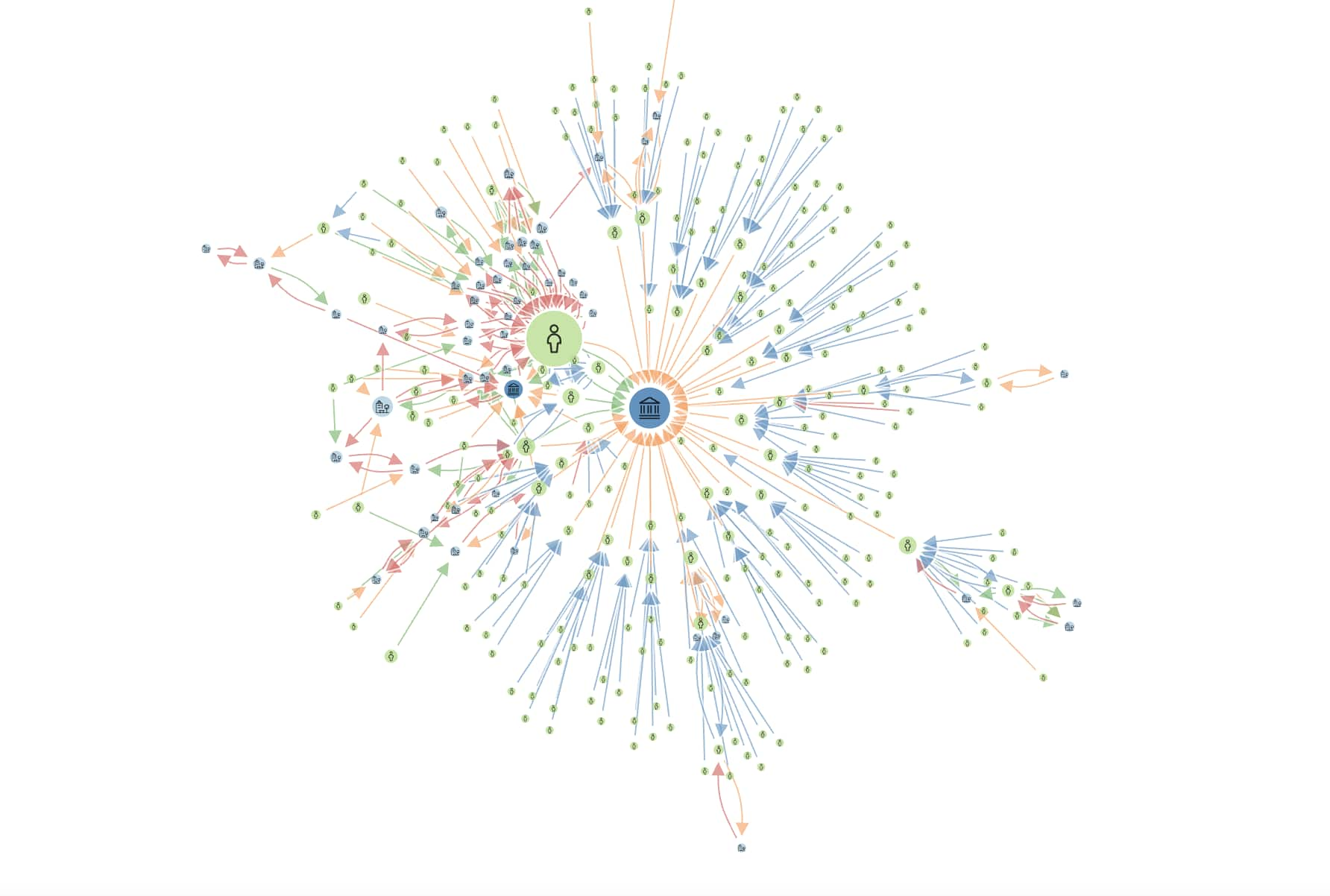

The monitors operationalise Legal Entity Identifier data to build a network of legal entities which form Globally Systemically Important Banks.

Demo

The monitors operationalise Legal Entity Identifier data to build a network of legal entities which form Globally Systemically Important Banks.

Demo

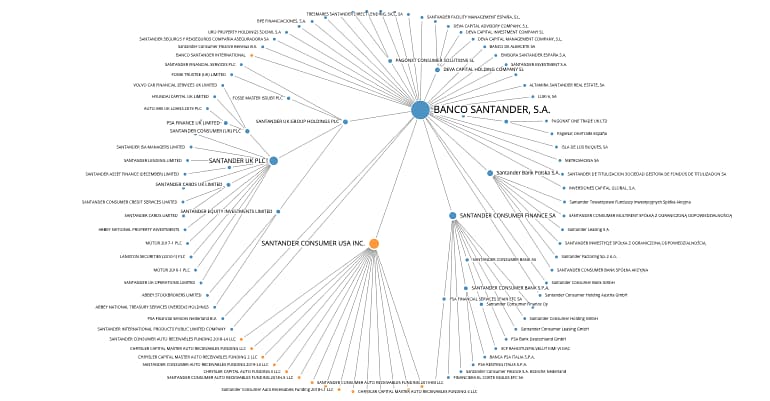

The monitor uses related parties analysis to build a network of open-source intelligence and corporate directorship around Cambridge Analytica.

Demo

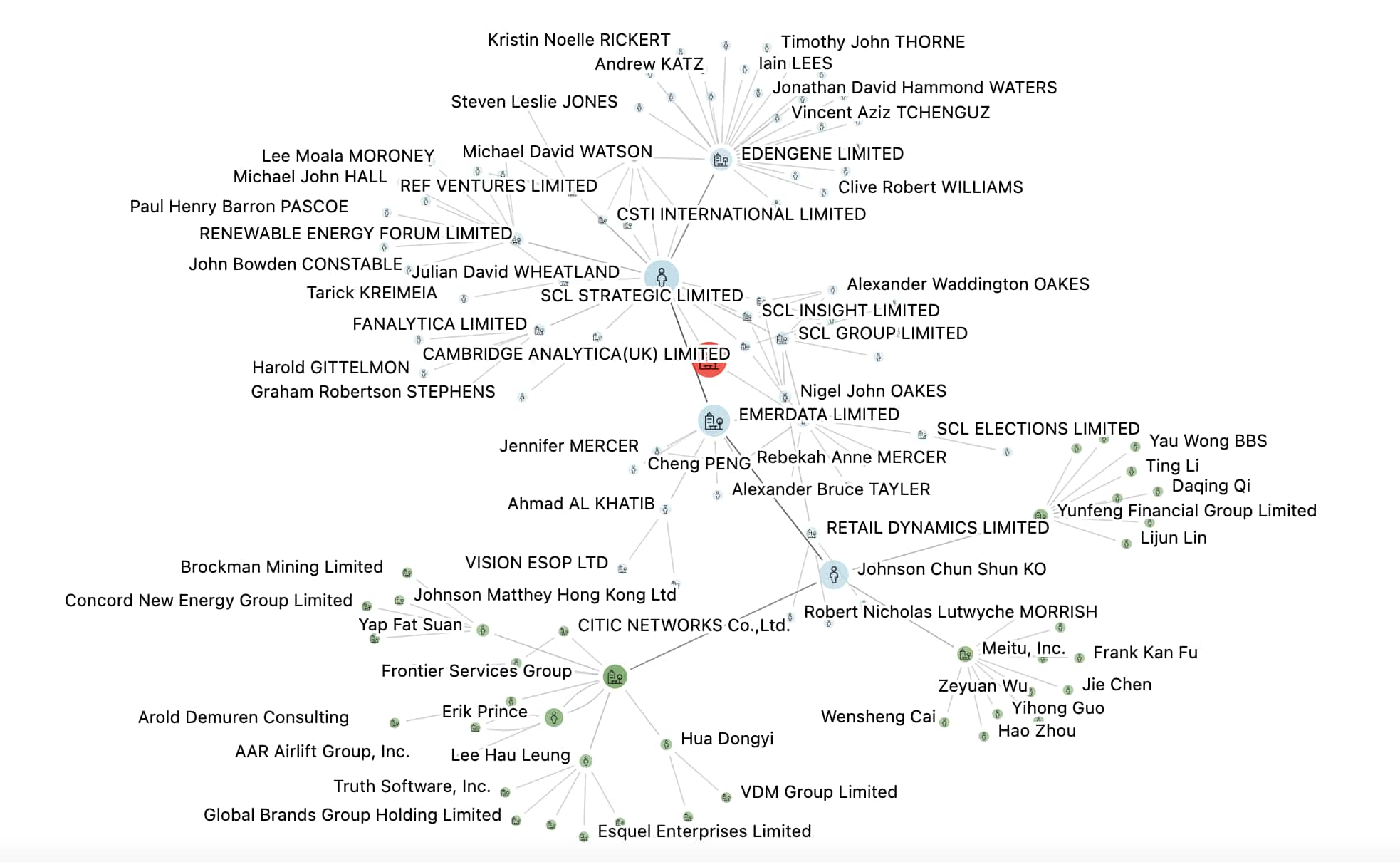

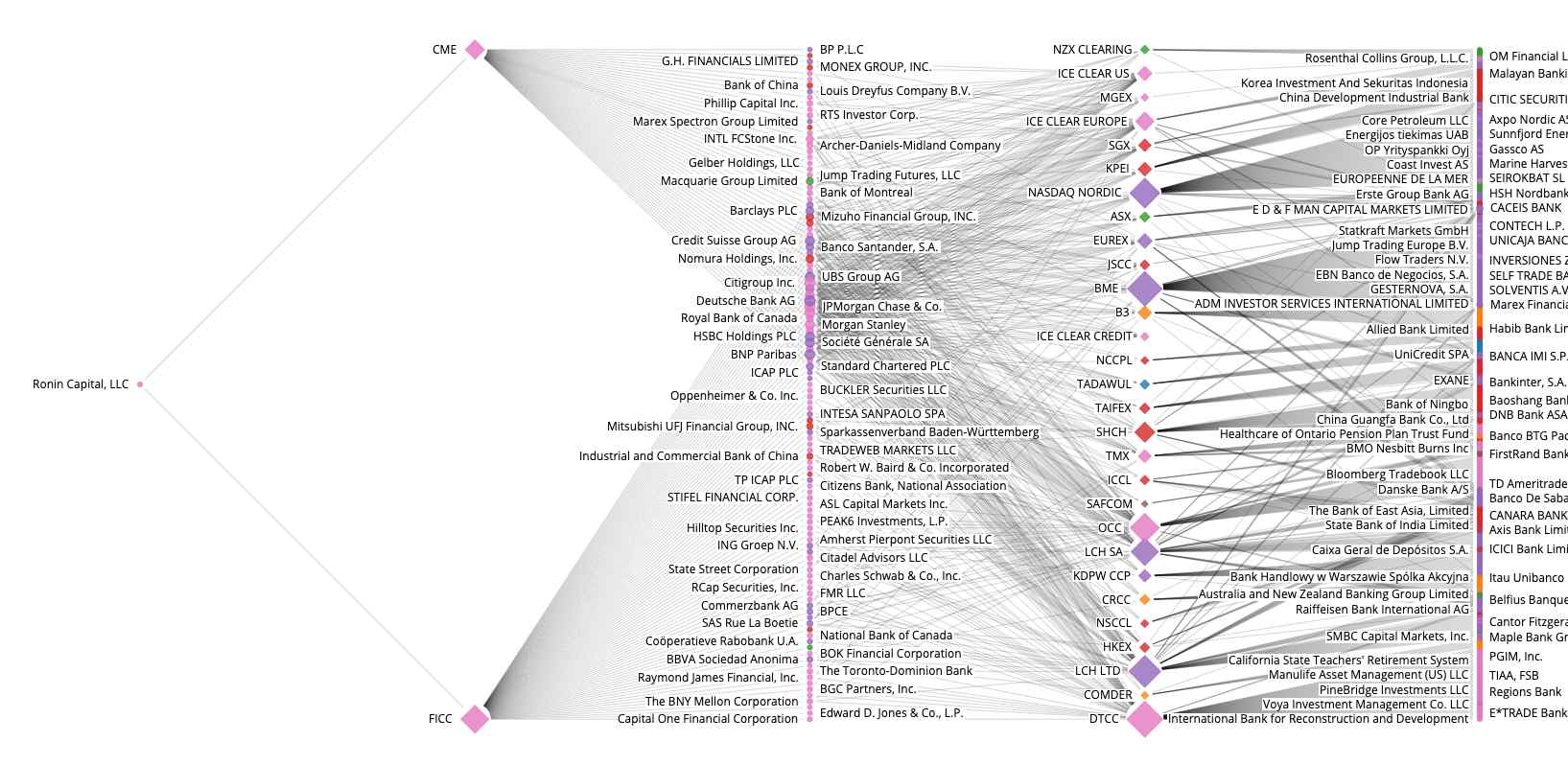

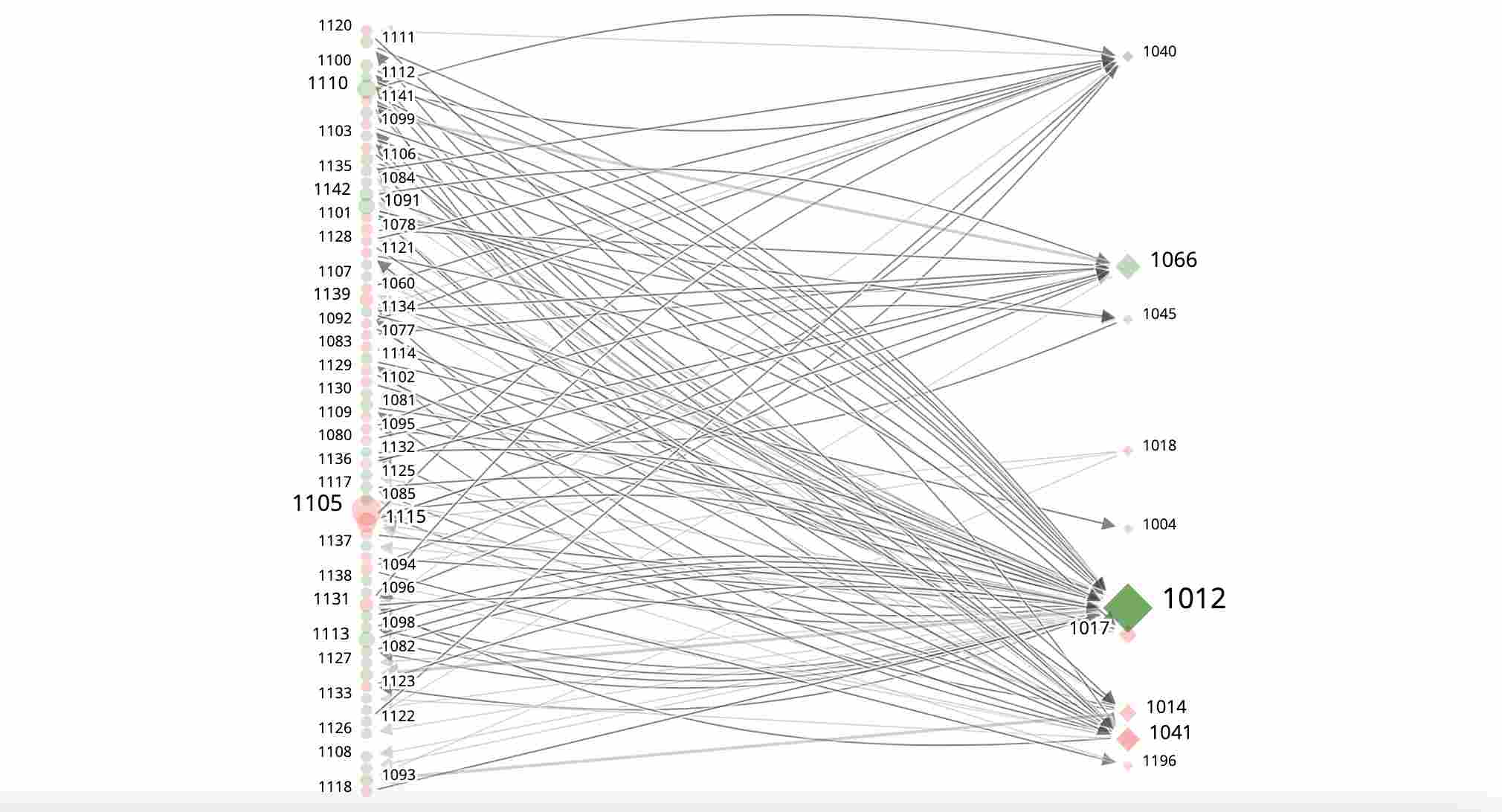

Examine possible contagion paths through which events can spread throughout large parts of the global financial system.

Demo

Investigate clearing network restructuring paths and the systemic risk implication of a failure of one or more clearing members

Demo

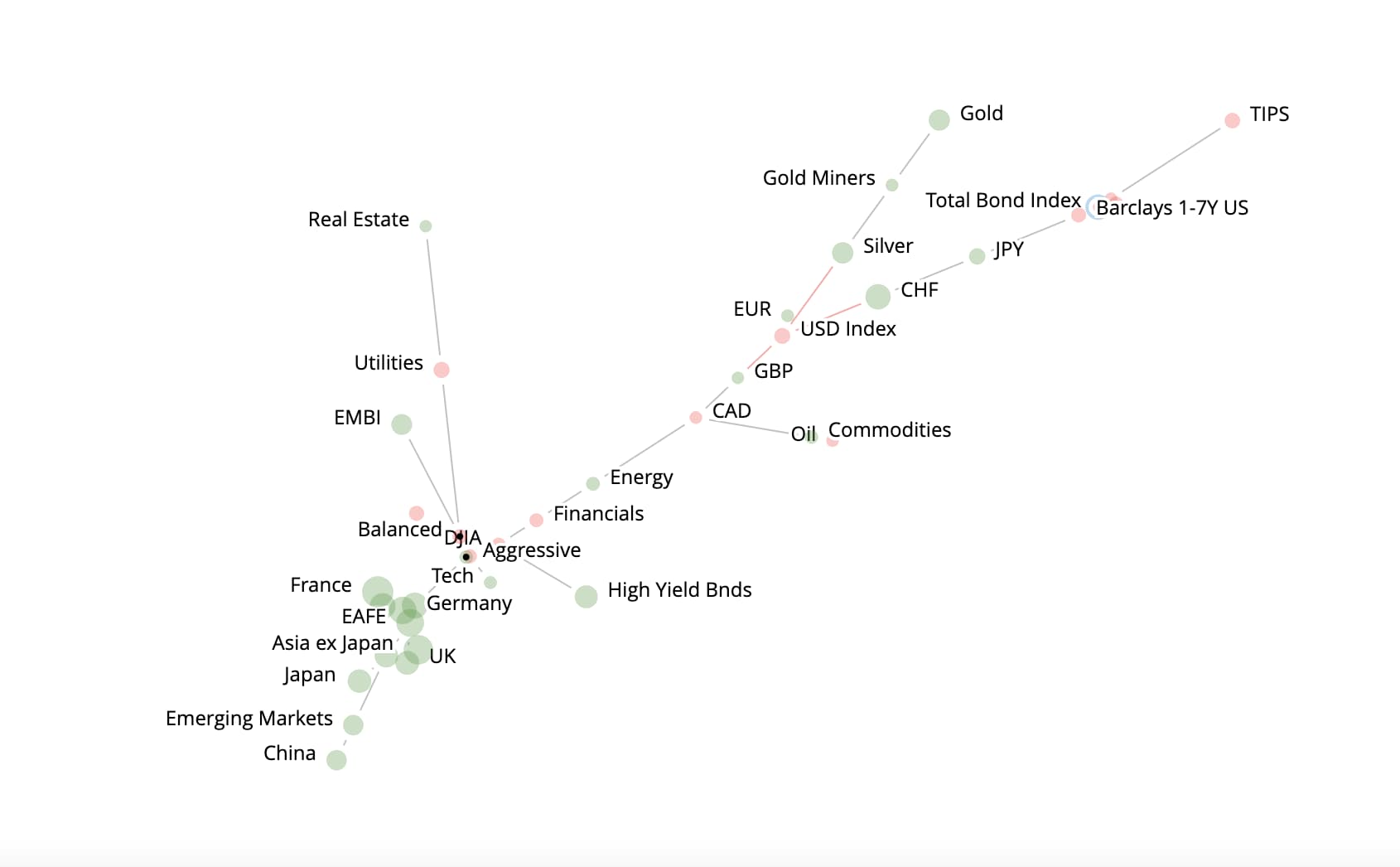

Monitor the global ETF market and its correlation network to gain a systemic view of recent developments and to build stress tests.

View monitor

Monitor the EU sovereign debt market and its correlation network to gain a systemic view of recent developments and to build stress tests.

View monitor

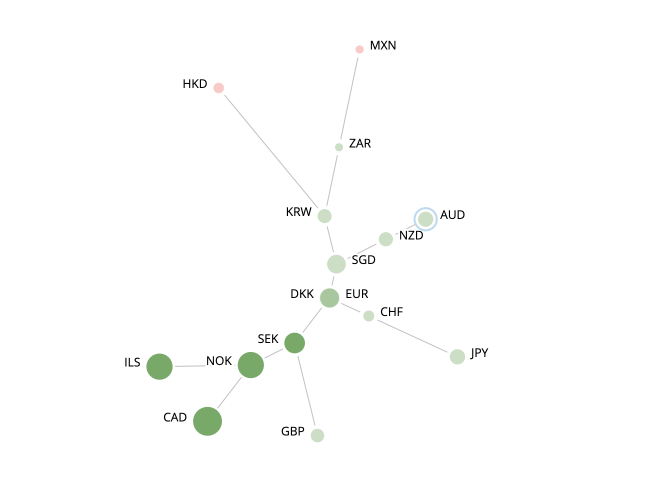

Monitor the global FX market and its correlation network to gain a systemic view of recent developments and to build stress tests.

View monitor

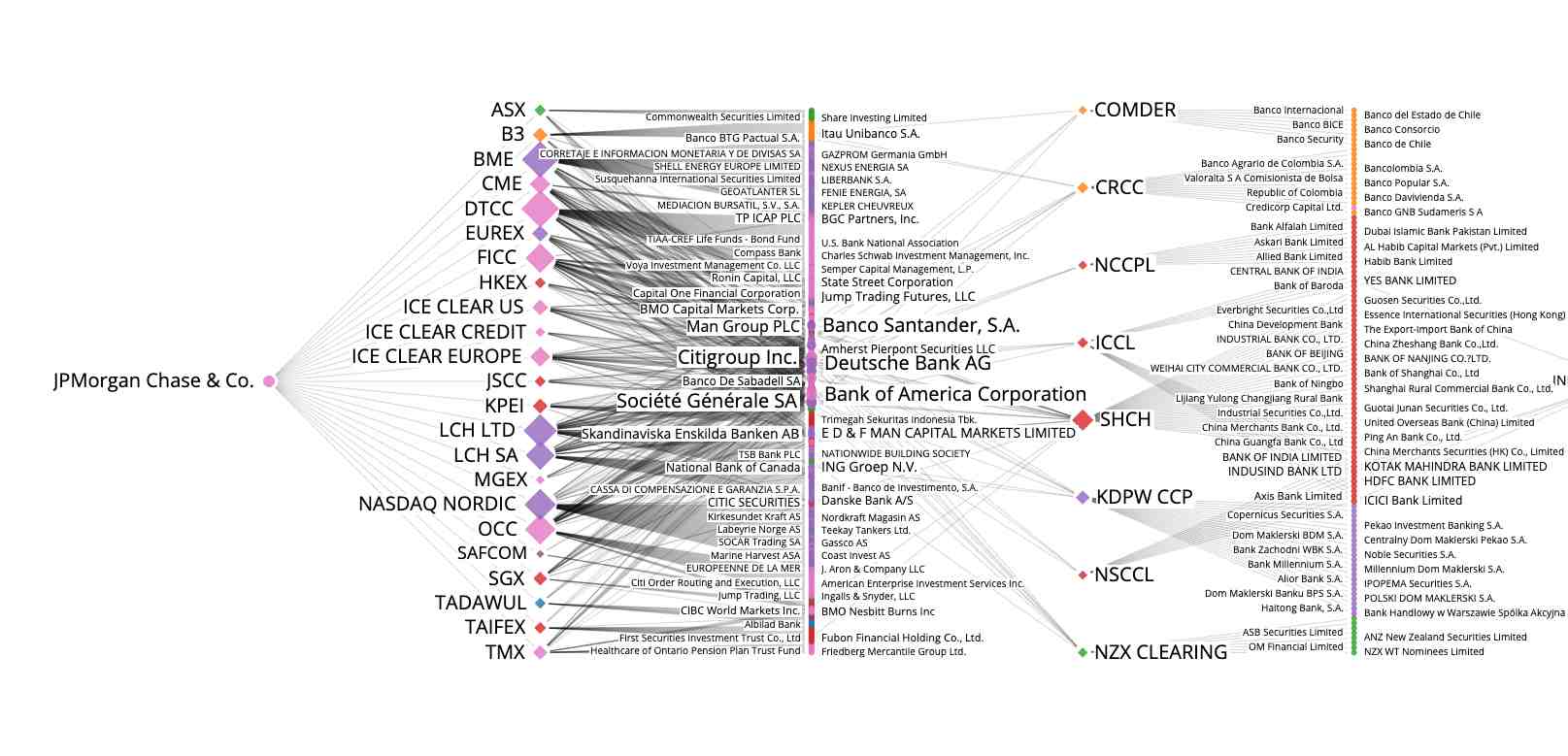

Monitor the topology of the global clearing system and related interconnectedness by using publicly available data on clearinghouse memberships.

Demo

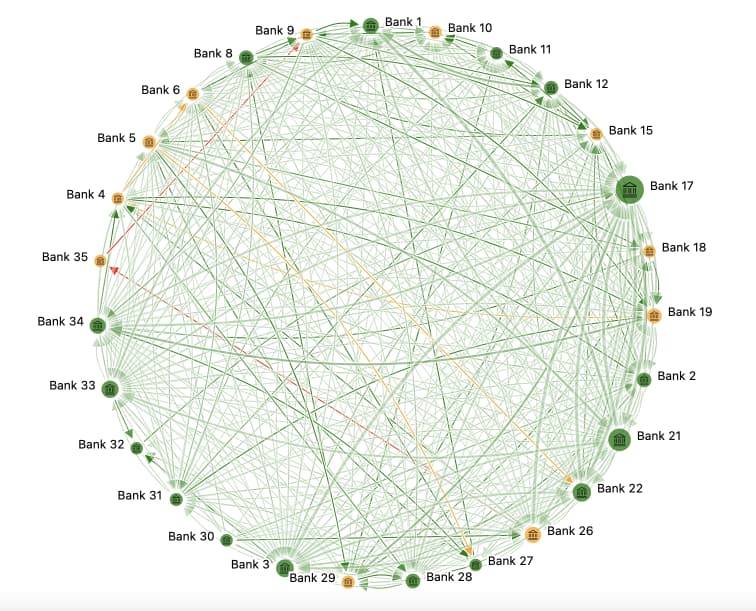

Examine possible contagion paths through which a hypothetical failure of a Globally Systemically Important Bank could spread throughout the entire system.

Demo

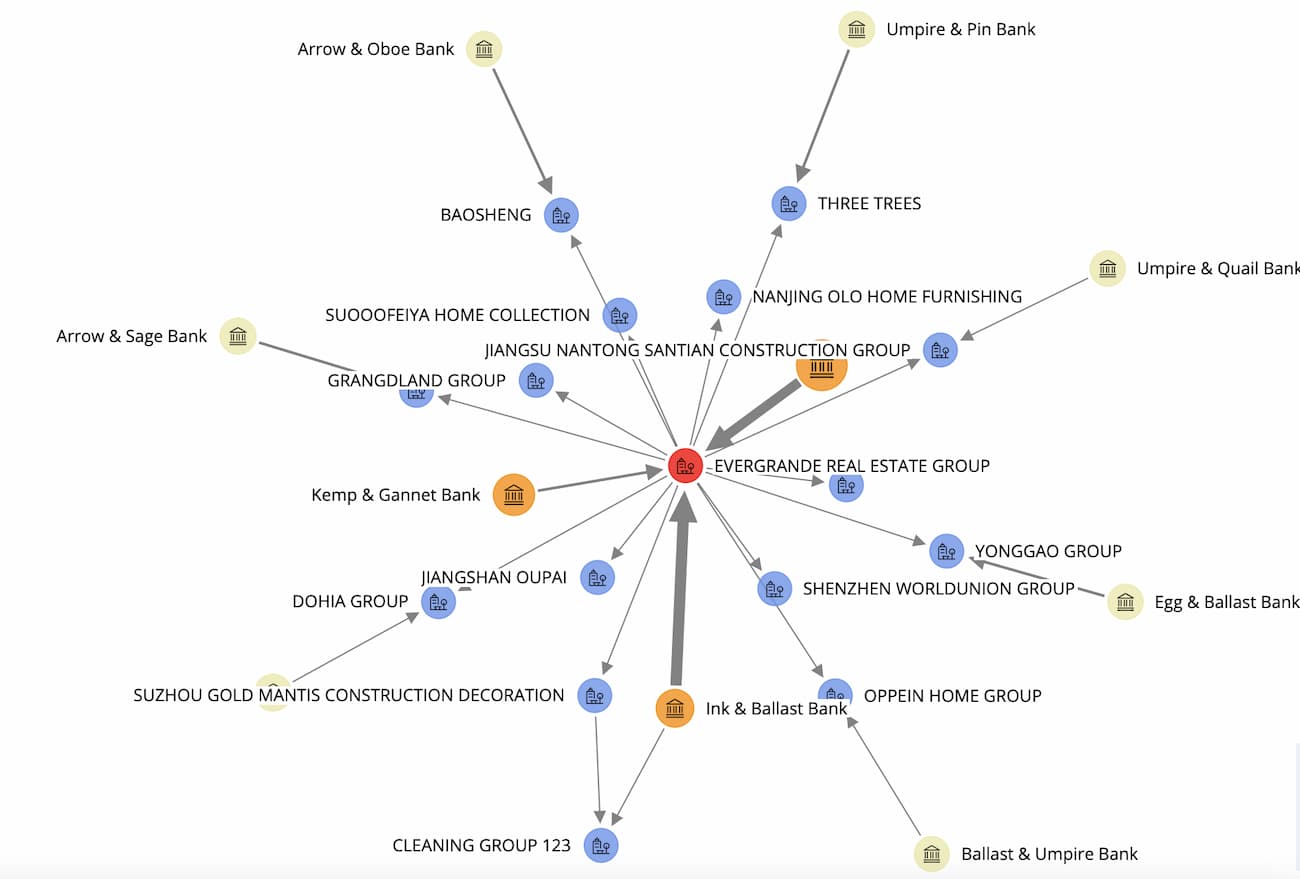

Monitor emerging credit risks and potential spillovers via three types of contagion channels - firesales, interbank lending and supply chains.

demo

Use real-time interbank payments data to draw conclusions and early warning signals about liquidity and solvency of banks.

demo

Monitor banks’ prudential returns data, including balance sheet information, credit risk and liquidity risk. Enhanced with publicly available LEI2 data.

demo

The monitor uses related parties analysis to build a network of the ownership strucutre and corporate directorship around Wirecard.

Demo